What You Need to Know About the Sequester |  |

- What You Need to Know About the Sequester

- Expect Fierce Competition in Small Business Book Awards – Voting Now Open

- The Buffer Social App May Be A Time Saver for You

- 3 Ways To Get Your Small Business Loan Denied

- Current Entrepreneurship Statistics and Trends

| What You Need to Know About the Sequester Posted: 05 Mar 2013 02:00 AM PST

For example, an estimated 35 percent of suppliers to the U.S. Defense Department are small businesses, according to the U.S. Small Business Administration. In 2011, the department awarded 20 percent of its contracts and 35 percent of subcontracts to small firms. Those small businesses benefited at the time, of course. And all of their employees and subcontractors benefited too. However, those businesses now could have their contracts canceled or drastically reduced as the Defense Department and other federal agencies begin to make cuts. Small businesses also face the uncertainty of not knowing when or how their companies might be affected. Economics expert Dr. Stephen S. Fuller of George Mason University told CBS News recently that the biggest problem is so many smaller firms may be suppliers or vendors for large, prime federal contractors without even knowing it. As a result, Fuller says these smaller firms could see sudden loss of business without warning. He estimates nearly half of a projected two million job losses resulting from the sequester could come from smaller firms. Not all small businesses with federal contracts are waiting around for the axe to fall, however. For example, software and high tech consulting company Geocent gets about 80 percent of its business from the Navy, the Air Force, and the U.S. Department of Veterans Affairs. The company is working to diversify by increasing sales in the healthcare, financial, and insurance industries, Ryan Lemire, executive director at Geocent told the Associated Press. In October, Small Business Trends founder Anita Campbell explained how the sequester might affect small businesses beyond those with federal contracts. Deep federal budget could cause a ripple effect, resulting in reduced gross domestic product, unemployment, and recession. Meanwhile, Bill Dunkelberg, chief economist for the National Federation of Independent Business, insists business owners shouldn’t listen to what he calls scare tactics by political leaders. See his take in the video below. Dunkelberg says the budget cuts will take time to implement and will be less damaging than a recent two percent increase in Social Security taxes in January. Small businesses must make efforts to move away from government contracts if possible, should the sequester continue. Business owners should also encourage their political leaders to end the sequester in Washington, but without tax increases that could be equally damaging to growth. The post What You Need to Know About the Sequester appeared first on Small Business Trends. |

| Expect Fierce Competition in Small Business Book Awards – Voting Now Open Posted: 04 Mar 2013 02:30 PM PST

Now in their 5th year, the Awards shine a spotlight on books and resources for entrepreneurs, small business owners, CEOs, managers and their staff. Expect the competition to be fierce. This year there are 10 book categories and for the first time ever the Awards include a non-book category for author resources. In previous years, almost 100,000 votes were cast. These are open Web-based Awards. That means anyone can vote – in other words, YOU can have a say in who wins. And the Awards are socially connected, so you can expect to see a lot of discussion on social media such as Twitter and Facebook. You are allowed to vote once a day, every single day, per nominee. Vote for as many nominees as you like. Oh, and the Book Awards website makes a fabulous place to find books to read and author resources. Meet our Sponsor, NamecheapThe 2013 Small Business Book Awards welcomes the generous support of Namecheap as Presenting Sponsor for this year’s contest. Namecheap is an ICANN accredited domain name registrar and web hosting company managing 3 million domains with more than 800,000 clients. If you need a website for your book or small business, we suggest taking a look at Namecheap. Thanks again, Namecheap! DetailsWho: Anyone may vote for their favorite book or resource. Vote for as many nominees as you wish. What: 2013 Small Business Book Awards. When: Voting goes through March 26, 2013. You can vote once a day (every 24 hours). How: It’s a one-click vote — no registering! It is easy – less than 10 seconds to vote. Where: To vote for your favorite book or non-book resource, search the list of nominees. Or just visit the 2013 Small Business Book Awards website. The post Expect Fierce Competition in Small Business Book Awards – Voting Now Open appeared first on Small Business Trends. |

| The Buffer Social App May Be A Time Saver for You Posted: 04 Mar 2013 10:00 AM PST If you are trying to keep an active presence on social that shares information, but are finding it difficult to keep up because of work and other obligations I might have a solution for you, Buffer. As I have stated previously I use Twitter to gather information on my industry and I share information as well. However, I can't share 15 articles at the same time because it irritates people. Sharing needs to be spaced out a bit, but who has time to sit and share every 30 minutes to an hour? With the Buffer App, I don't have to sit in front of a computer all day to share to my Twitter account, Facebook account, Facebook pages and Linkedin. Buffer does it all for me and it can help you as well. What Is the Social Sharing App, Buffer?It is an app tool that allows you to share and schedule from your browser, your mobile device or from Web pages. With Buffer you can share images, video, articles, news and more. This tool is fast and simple. You can use Buffer to manage your social accounts and your clients’ accounts at the same time. What Accounts You Can Add to Buffer

Creating a ScheduleFor each profile you have added you can create a publishing schedule where you get to pick the days and times for the items you add to Buffer. This allows you to have diversity in publishing times across social accounts. How to Add Items to BufferThere are a lot of ways to add things to Buffer and their site lists each of the ways. I am going to review the main ways I add to Buffer just to make things simpler. Login in to Buffer You can login to Buffer from anywhere and add things to share socially. You login and just click on a box that says "What do you want to Share." When you do, the box below appears and allows you to add text, a link and then lets you choose which accounts to share the info with. Share from Your Browser Extension If you are reading an article or news item you want to share you can just click on the Buffer icon extension in your browser. Below is a picture of what the icon looks like in Chrome. When you click on the icon, a box pops up that allows you to decide which social accounts you want to share the page, article, video or image with. It pulls in a thumbnail of the image on the page, link and excerpt for social networks like Facebook and Linkedin. Here is what it looks like: Mobile Devices Buffer has apps for multiple mobile devices that allow you to share and also keep track of what has been shared: Web Pages with Buffer Share Buttons

These buttons also keep track of the number of times the item has been shared with Buffer. Buffer AnalyticsBuffer also keeps track of sharing data for each social account and each item shared. This data can help you see how engaged your audience is, which audience is more engaged in regards to network vs. network, what types of shared items do best with your audience, track number of clicks and it also keeps a nice clean record of what you have shared in the past. This is great data to have. Other Buffer OptionsBuffer has a free version and a paid version. The paid version gives you a lot more freedom for $10 a month. The paid version also allows you to add team members so it isn't just up to one person to run and maintain all your social accounts. Buffer also has a link shortening function and integrates other services that you can use (free option). Why I Use ItI use Buffer for several reasons, but the main reason is that it saves me time. It also allows my social accounts to remain active when I can't be due to meetings or just life. The analytics are very informative and helpful to me, especially in regards to clicks on Facebook, which I wasn't able to monitor before. It allows me to share with client accounts and track the data for them as well. This is one tool that is so easy to use that it is actually faster than sharing by hand. It is fast and simple and makes my life easier. I recommend you try the free version and see how it works for you. Mobile Image Credit: Apple / Buffer The post The Buffer Social App May Be A Time Saver for You appeared first on Small Business Trends. |

| 3 Ways To Get Your Small Business Loan Denied Posted: 04 Mar 2013 07:00 AM PST

At the top of those lists of reasons why businesses fail are:

I would totally agree with the lenders and accountants of the world who also warn against excessive debt. But let's remember that the excessive debt conversation is almost always about people who use capital poorly. I've yet to read case studies about business owners who properly acquired their small business loan or line of credit, then used the financing wisely and strategically, and then failed due to excessive debt. So if we believe that financing, when acquired and used wisely, can be a great growth and expansion tool – what are the 3 most common mistakes that entrepreneurs and small business owners make that makes it difficult or impossible for them to get approved for financing? And what happens when these mistakes are made? We see several hundred requests for financing each and every month. Here are 3 things that will hurt your chances of getting that small business loan approved. Ways to Get Your Small Business Loan DeniedLack of Strategy You don't know what your borrowing options are. So you apply for a loan(s) without having any knowledge or strategy behind the plan. In other words, there is no plan. A plan would mean that you know what you can and can't do, based on the lending solutions that are available to small business owners. When you boil it all down, there are probably 10-12 primary types of debt solutions that do not require you to give up ownership of your business. Do you know what those are and which ones are the best fit for you? Things like credit, industry, seasoning, location, collateral, cash-flow, reserves, your need/purpose, etc. will all be factors that determine your options. Bottom line: With knowledge there is a path forward for you that either gets you that coveted financing now – or later. Get on that path and pursue your objective with a plan. Investigate startup financing options. Failure to Treat Your Credit as an Asset You're not treating your credit as the asset that it is – or could be. There are a couple of simple facts here. You either have excellent credit that is robust with no blemishes, and low utilization on your credit cards – or you don't. If you are part of the 10-20% that have this excellent credit profile, are you protecting and preserving it as you start, build and grow your business? If you're part of the 80-90% who have one or more issues with your credit (derogatory items, high revolving debt, etc.), what are you doing to intentionally improve your credit profile and FICO scores? In the world of small business loans, you may not have as many options as you think just because you have great credit. But there are some good options when your credit isn’t so great. The most common error here for small business owners is the improper use of credit cards. Don't use personal credit cards for business. Why? One reason is because 30% of your FICO score is determined by your utilization percentage. Using personal cards guarantees you will hurt your credit profile and FICO scores. Ouch. Additionally, not all business cards are created equal. Some business credit cards report every month to your personal credit report. Ouch again. Don't believe the hype about using personal cards for business because of their protection under the CARD Act. Rates are higher since the CARD Act and you'll hurt your credit if you use personal cards for your business. If you think you're okay because you pay your bill in full each month, then think again. Credit card companies report the balances to the credit bureaus when they cut your statement and not after your due date. So 9 times out of 10, your balances are going to show on your credit report and lower your FICO scores. Paying your bill “on time” or “in full” will not change that. Failure to Build and Grow Your Revenue You're not building and growing your revenue. It's true that your financing options will increase and get better as your business gets older. However, this is mainly true if you're growing your company revenue. Remember, Peter Drucker said that business all boils down to innovation and marketing and it's your marketing plan (did I have the nerve to say "plan") that will help you grow revenues. Do this and your success, for both your business and financing needs, are within reach. Plans require research. They mean nothing without execution. So your research should bring you to marketing solutions like inbound marketing, content marketing, direct mail, etc. These are the three things that are commonly ignored by small business owners as they grow their companies. Be informed. Knowledge is power. Leaders learn and grow and figure things out. So put yourself in the minority by being prepared for the financing you need to get your business to the next level. Nobody said it was easy. But it's also not rocket science…thank goodness for that. Denied Photo via Shutterstock The post 3 Ways To Get Your Small Business Loan Denied appeared first on Small Business Trends. |

| Current Entrepreneurship Statistics and Trends Posted: 04 Mar 2013 04:00 AM PST The Business Administration recently released the 2012 Small Business Economy, its statistical report on small business. Because the report provides the latest available data on several key small business statistics, its publication provides me with an opportunity to update five charts that I have published at various times in various places, including Small Business Trends. Employer Firms Continue to Shrink as a Fraction of all Businesses As the figure below shows, businesses with employees comprised only 20.6 percent of all U.S. companies in 2010, down from 26.4 percent in 1997.

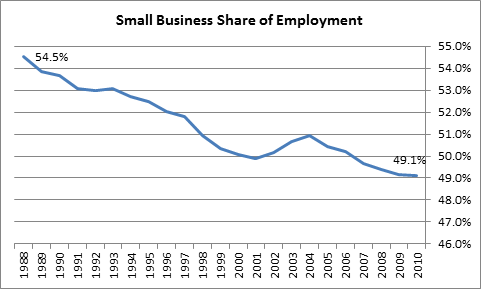

Small Business's Share of Private Sector Employment Continues to Decline As the figure below shows, small business employed a minority – 49.1 percent – of private sector workers in 2010, down significantly from the 54.5 percent it employed in 1997.

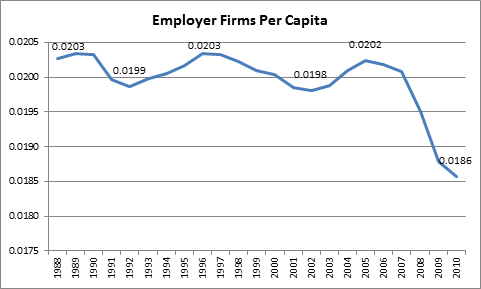

The Number of Employer Firms Per Capita Continues to Decline As the figure below shows, the number of employers per member of the population continued to fall in 2010, continuing a decline that began in 2005, before the start of the Great Recession. Between 1988 and 2005, the number of employer firms per capita fluctuated between 1.98 and 2.23 firms per thousand people.

Employer Firm Formation has Stabilized, Though at Below Pre-recession Levels As the figure below shows, the number of new employer firms founded per thousand people edged up from 1.70 to 1.73 in 2010, after having declined significantly from 2006 through 2009.

Self-employment Rates Continue to Fall As the figure below shows, the combined incorporated and unincorporated self-employment rate declined from 10.3 percent of the civilian labor force in 2000 to 9.5 percent in 2012. While the incorporated self-employment rate was higher in 2012 than in 2000, its rise did not offset the decline in the unincorporated self-employment rate. The latter had been trending downward since the mid-1990s, after remaining largely flat between the early 1970s and mid-1990s.

The post Current Entrepreneurship Statistics and Trends appeared first on Small Business Trends. |

| You are subscribed to email updates from Small Business Trends To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

Small businesses contracting with the federal government will be first to feel the effect of the sequester, the name for across-the-board federal budget cuts that went into effect in Washington Friday.

Small businesses contracting with the federal government will be first to feel the effect of the sequester, the name for across-the-board federal budget cuts that went into effect in Washington Friday. The nominations are in. Now it’s time to vote for your favorites in the

The nominations are in. Now it’s time to vote for your favorites in the

“If only I could get a small business loan for my business.” What a common thought by many of us! Business owners need small business loans and access to working capital to start, build or grow their businesses. Statistics abound on the reasons why businesses don't succeed.

“If only I could get a small business loan for my business.” What a common thought by many of us! Business owners need small business loans and access to working capital to start, build or grow their businesses. Statistics abound on the reasons why businesses don't succeed.

Source: Created from Bureau of Labor Statistics data.

Source: Created from Bureau of Labor Statistics data.

No comments:

Post a Comment